Discover advantages of zero-based budgeting compared to traditional budgeting in the COVID-19 era.

In your business management meetings, you’ll have heard ‘normal’ financial and non-financial reporting such as “sales are 15% higher than last year.” “Marketing spend is 8% below the last 10-year average.” “GDP is up 0.3% on last year” or “traveling activity is 15% below average”. But how do you relate these familiar measures to your business now during abnormal times created by COVID-19?

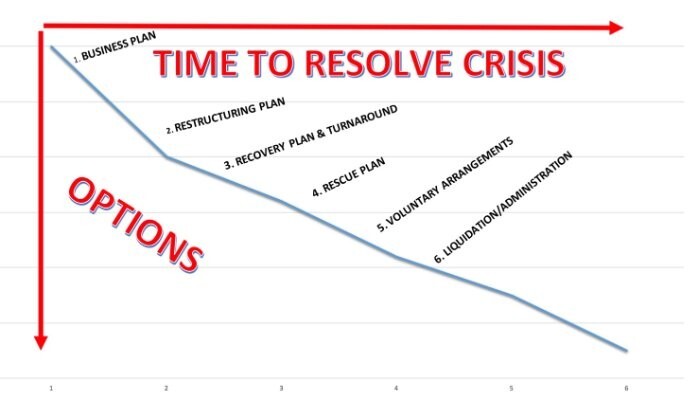

Can your business react to the new scenarios that the world faces since March 2020? Yes, you can! How? Dramatically change the way in which your business plans using a toolkit called zero-based budgeting (ZBB).

House_Collapsed_Zero_Budgeting. I like analogies so imagine this situation using ZBB is the equivalent to rebuilding a house after an earthquake. A house should not be rebuilt in the same way as it was destroyed. You would rebuild it with a fresh pair of eyes starting from the ground up and make full use of the space. This is how zero-based budgeting works. With this technique, each cost activity is justified regardless of previous business activity. Even if your business may not have been destroyed, the market around it is likely to have changed and so the assumption of your plans would need to be modified.

Incremental Budgeting vs Zero-Based Budgeting. Why now?

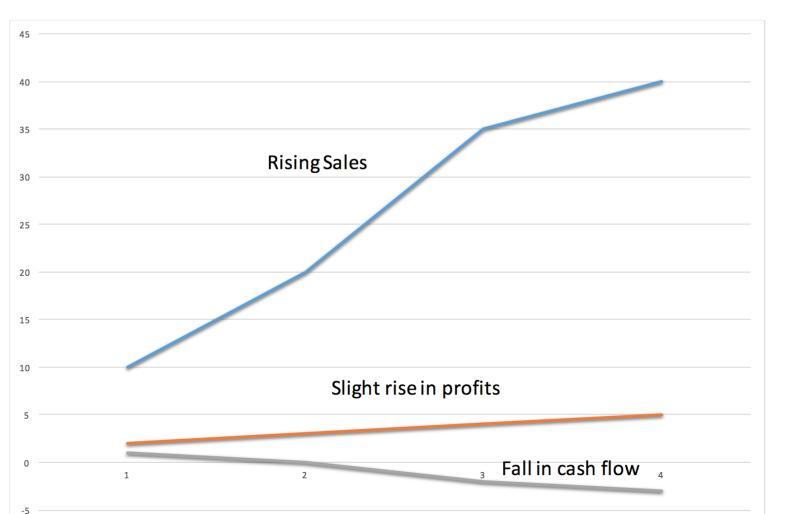

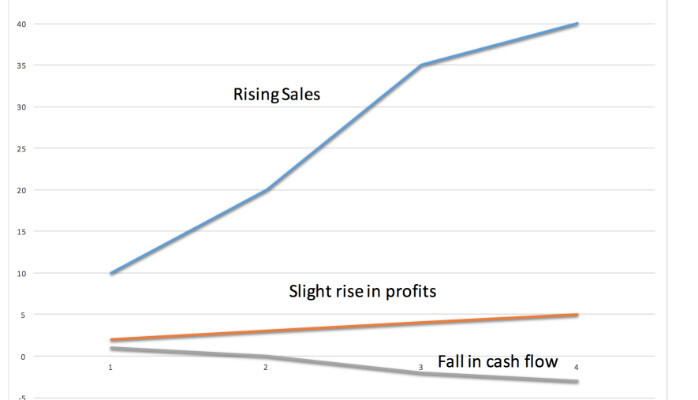

Over the last 6 months, an unprecedented “financial reset” process has taken place. The behavior of costs, revenues, cash flow patterns have all been subject to unpredictable change.

The role of the Finance Director is to facilitate the best performance, to make the performance sustainable and controllable, to align employees and managers, to foster the best possible processes and maximise the brand reputation.

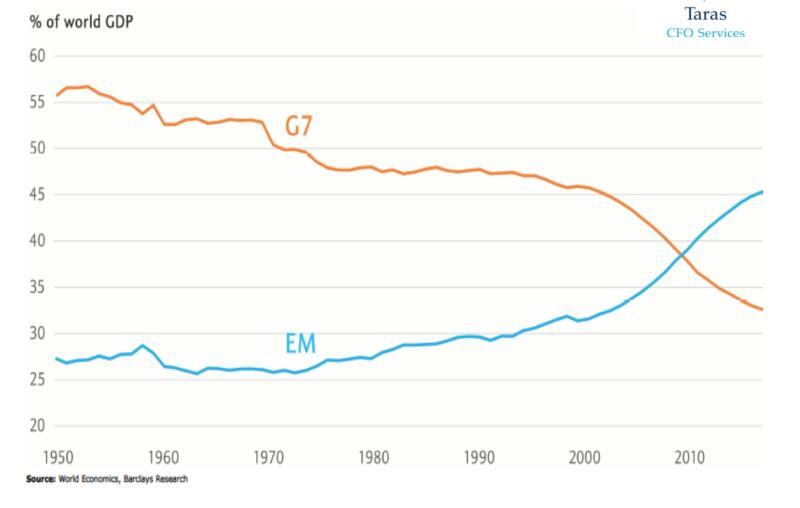

COVID-19 is probably one in a century event but, most importantly, has completely reset expectations on a number of business models. Examples are commercial real estate and retail business behavior, in a sector in which “default thinking” and, therefore, incremental budgeting has been practiced for some time.

This type of “default thinking” and, therefore, “default incremental budgeting” can no longer apply in the current economical environment, hence zero-based budgeting is now required to address the totally new economic environment we all face.

Where to start with Zero-Based Budgeting?

Look at all your costs including your suppliers and internal. What do you spend your money on? Are you getting value for money? Do these activities still need to happen at all or differently?

Ask yourself, could we produce this internally, does this have the desired outcome we need, is there still demand for this service/product, can we source the same quality product or service elsewhere?

You’re likely to need access to your company financial reports pre COVID-19. Do you have these to hand and can you translate the figures to make sound decisions? Do you need help to explain zero-based budgeting to budget holders and get this off the ground? A Finance Head can join your business on a flexible (as needed) basis to help your business survive this challenging period. Please contact us we can put forward the best Finance Head for your business. You can then have a no-obligation confidential chat about your business challenges.