The story of the Titanic has always been exemplary of what might happen to any business at any time at any latitude. During its journey from Southampton to New York, the captain gave orders to accelerate its speed as the ship was believed to be “unsinkable”. There was no risk management as there was no expected risk! Don’t let your business hit a ‘hidden’ iceberg!

This attitude is quite common amongst businesses, especially SMEs when business owners decide that no proper risk management plans are required to support the long-term stability of the business. The reality is very different, in fact, no business can be immune from any external risk as COVID-19 has brutally demonstrated.

Other examples of external risks are customers withdrawing orders, suppliers defaulting on obligations, key employees lost to competitors, unexpected tax and political changes, pandemics completely redesigning economies and default thinking. The list could go on and on.

What is the Role of a Finance Director in Managing Risk?

The opposite of risk is an opportunity. A risk is something to mitigate (the iceberg!), while an opportunity is something to maximise.

Each business then has to manage risks and to exploit opportunities. How do we do this? Very simply, any planning activity needs to address risks and each risk needs to be quantified with a probability and expected impact.

On the other hand, opportunities need to be equally quantified and chased for potential maximum benefit.

To simplify: It is the role of the Finance Director to ensure that risks are managed and minimised while opportunities are maximised and taken advantage of. This will ensure that maximum valuation is always achieved for the business and that progress is always on track.

Can Icebergs be Avoided?

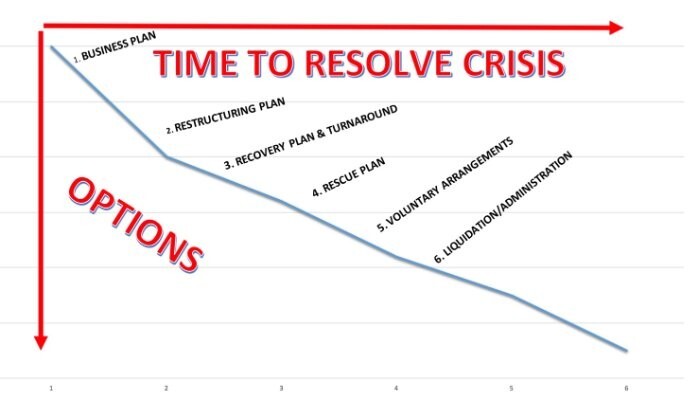

Yes! Business icebergs should always be anticipated, keep a lookout and have a plan to address the change and react quickly when you need to to avoid critical damage to your business. Sometimes a collision will be in your blind spot and come upon you suddenly, such as COVID-19, but it those businesses that have a plan and change their course and speed with assurance to back-up those decisions will come through potentially stronger than before. Always be aware of blind spots such as customers running into difficulties and unable to pay which can be anticipated. These risks should be mitigated to be eliminated.

Have Your Own 'Risk' Lookout

Your Finance Head can be your navigator and inform you as captain when to take a different course or be wary of dangerous waters ahead. Your own Finance Director can help you create risk management plans to charter unknown waters. Get in touch with us to discover your own virtual Finance Director for your business.